Unmasking The Hidden Billionaire Behind A Korean Beauty Kingdom - Forbes - Hello friends Beauty tools and beauty tips, In the article that you are reading this time with the title Unmasking The Hidden Billionaire Behind A Korean Beauty Kingdom - Forbes, we have prepared this article well for you to read and take the information in it. hopefully the contents of the post what we write you can understand. all right, have a nice reading.

Unmasking The Hidden Billionaire Behind A Korean Beauty Kingdom - Forbes |

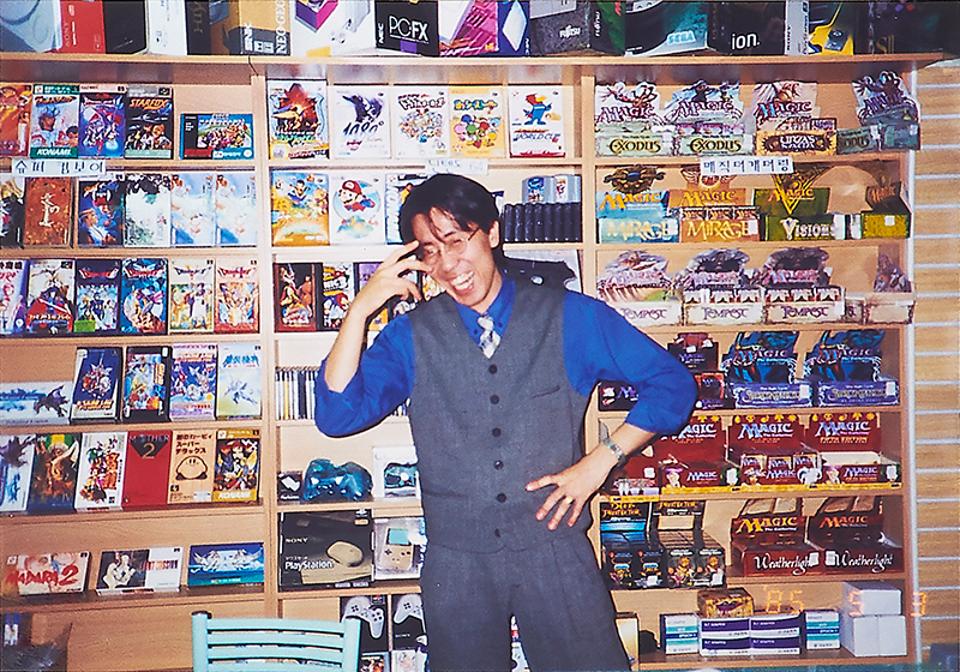

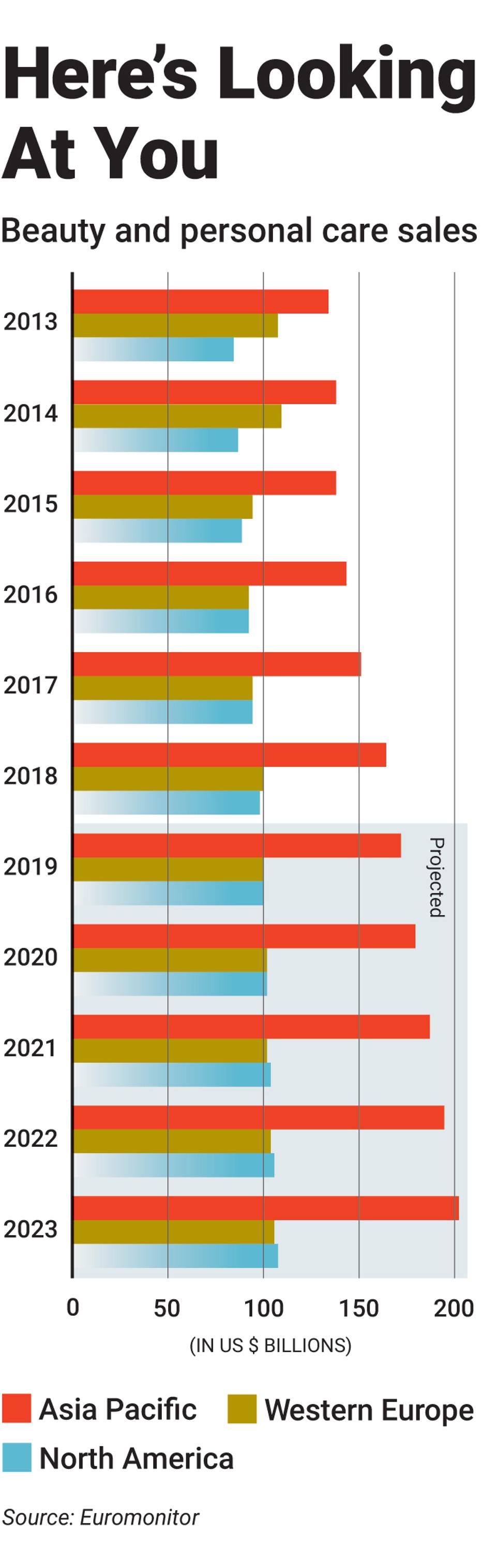

| Unmasking The Hidden Billionaire Behind A Korean Beauty Kingdom - Forbes Posted: 21 Aug 2019 12:00 AM PDT Liu Jing, 32, is visiting Seoul from China's eastern seaboard. Other tourists might spend their day taking in the capital's sights. Not Liu. She's lining up behind at least a dozen compatriots in a duty-free shop, waiting her turn to buy JM Solution facial sheet masks. Each box of ten will cost her about $30, but Liu won't walk away with just one. For the equivalent of $18,000, she and the others buy three refrigerator-size palettes of carts—so big they have to be wheeled away on dollies.  This is the latest article is in a new series: World of Forbes, a collection of stories from our 35 licensed editions and global partners around the planet. This story originally appeared in the July-August issue of Forbes Asia. Liu isn't buying them for herself. She's a daigou—a Chinese term for surrogate buyers who venture abroad to stock up on popular products and resell them back home. To say JM Solution masks are popular is an understatement. Between the Honey Luminous Royal Propolis Mask, the Lacto Saccharomyces Golden Rice Mask, and the Active Pink Snail Brightening Mask, JM Solution's owner, GP Club, has sold more than a billion skin-care masks, mostly in China, since launching them in mid-2017. "It's the No. 1 seller in China," Liu says, adding that she can earn as much as 20% selling JM masks back home in Shandong province. "I've been coming here once a month for the past six months." Daigous like Liu are partly responsible for catapulting Kim Jung-woong, GP Club's founder and CEO, onto Forbes' list of Korea's 50 Richest at No. 30 with an estimated net worth of $1.15 billion. Kim, now 44, started his own video game store in high school and within a decade had earned enough to venture into China's gaming accessories market. A decade after that he pivoted to cosmetics in the mainland. But after a diplomatic dust-up that began in 2016 sparked a boycott in China of Korean products, Kim cultivated a following among the mainland's social media influencers, triggering an invasion of daigous determined to bypass the boycott and ship GP Club's masks from Korea to sell back in China themselves.  Kim circa 1993 at one of his video game stores in Seoul. courtesy of gp clubThe daigous not only blunted the boycott's impact, but also helped GP Club grab market share from big-name Korean brands such as Amorepacific and LG Household & Health Care. Driven largely by demand from China's consumers, sales at GP Club rose nearly tenfold last year to 514 billion won ($460 million), while net profit rose more than 30 times, to 170 billion won. "I rode the wave well," Kim says in his first major interview since becoming a billionaire. To cope with the growth, he quintupled his staff to 170 last year. "But if you asked me to do it again, I probably couldn't," he says. GP's staggering expansion prompted Goldman Sachs last October to pay 75 billion won for a 5% stake in the company, making Kim, who with his wife and daughter owns roughly 95% of the company, a billionaire. Confident it can sustain the momentum, GP says it has mandated banks to arrange an IPO in Seoul, which could take place later this year. "While the incredible growth in sales of JM Solution's innovative products caught our initial attention," says Jonathan Vanica, a managing director at Goldman Sachs who led its investment in GP, "it was the company's deep understanding of the Chinese consumer's ever-evolving, internet-driven tastes and their firsthand knowledge of online and offline nationwide distribution channels that truly excited us."  Shoppers waiting to enter the Lotte Duty Free Shop in Seoul Jun Michael ParkKim's road to China's $15 billion a year facial mask market was long and winding. The youngest of three siblings, Kim had a comfortable childhood until his father, a well-to-do bank branch manager, lost his job and the family's money in a failed foray into politics. Kim's father traded his white-collar shirts for a construction laborer's helmet. They were hard times, Kim recalls. Rice was a luxury; the family ate barley instead. When Kim was 15, his father died of liver cancer, leaving his mother and grandmother to raise him, his brother and sister. Hardship ignited his entrepreneurial flame. "Early on, I felt driven by the need to make money," he says. An avid gamer like so many teenagers, Kim landed a part-time job at a small video game store run by an elderly couple. Kim's fascination with games quickly translated into a talent for selling them. With $4,000 he saved from his job and $3,000 borrowed from his family, Kim opened his own small store selling video games and consoles from an apartment and called it Game Paradise, the origin of today's GP Club. Kim would open shop after school and sell video games until 11 p.m., fashioning homemade loyalty cards—"Buy 10, get one free"—to encourage repeat business. When he'd made enough money, he used it to open a second store in another apartment nearby. By the time he was 20, Kim had amassed a small fortune of 300 million won (equivalent to about $500,000 today). After a four-year interlude—two years performing Korea's compulsory military service and another two earning a degree in interior design from a vocational college—Kim started plowing his savings back into expansion. He opened a new branch of his store in an electronics mall and eventually added five more there. Video games weren't the only thing moving out of GP, though. Kim noticed that customers were also keen on nylon and polyester shoulder bags to protect their precious PlayStation and Nintendo gaming consoles. So in 2003, Kim made the first of what would be many trips to China, where the carriers were made, to secure a network of suppliers. GP's game and accessories business grew to generate, at its peak, as much as 50 billion won in annual sales.   Daigous hauling refrigerator-size carts of JM Solution masks to sell back in China. Jun Michael ParkKim picked up more than bags in China. He learned Chinese and, he says, "a lot about the Chinese culture and the habits of people." Kim was quick to spot the resurgent popularity of Korean pop culture in China, part of a second K-Pop wave like the one that swept Asia in the 1990s, but now supercharged by the rise of social media. With the new craze for Korean bands and TV dramas came a yearning to emulate the fair and dewy skin of their stars: the K-Beauty trend. Korea's biggest beauty brands had been exporting to China for years; now even smaller brands could sell to Chinese consumers online or to the rapidly rising number of Chinese visiting Korea. The second wave gave Kim the chance to make use of his China connections, and in 2013 GP became the distributor for Korean brands still trying to ride the K-Beauty wave into China's market. "It did incredibly well—at first," Kim recalls. But his role as middleman was precarious: As his Korean clients' sales soared, they began cutting him out and selling directly to China's retailers. Turning to a small Korean cosmetics factory in April 2016, Kim launched his own brand of body washes and lotions, JM Solution, which stands for "Journey to Miracle." JM's first product line was gaining popularity, but its rise was cut short when, in the summer of 2016, Korea agreed to deploy the U.S. THAAD anti-missile system on its turf, designed to protect it from North Korean missiles. Beijing, worried the system's radar could penetrate Chinese territory, interpreted the development as a national security threat and retaliated swiftly by banning Chinese group tours to Korea. "Before the crisis, 800,000 Chinese were coming to South Korea every month," says Park Hyun-jin, an analyst at the DB Financial Investment brokerage in Seoul. "It fell to about a quarter of that." State media also urged China's consumers to boycott Korean products. Sales at Korea's largest cosmetics firm, Amorepacific, dropped by more than 9% during the two-year boycott. Its net income tumbled by more than half. "The appetite for K-Beauty was big," says Lee Sun-hwa, an analyst with Eugene Investments and Securities in Seoul. "But with the tourism ban, there were fewer channels for Chinese consumers to purchase these products directly." GP wasn't spared. "I lost a billion won I couldn't get back from one retail partner. We had orders of three billion won being cancelled," Kim says. "People were literally telling me, 'Stop producing.'" He didn't. Instead, Kim invested all his money at the time—1.5 billion won—into a new product: facial sheet masks. Unlike traditional facial masks that are brushed on as a paste and then allowed to dry before being peeled or washed off, facial sheet masks are tissue-thin sheets cut to fit the face—with holes for the eyes and mouth—and coated with chemicals designed to moisturize and rejuvenate the skin. China's consumers buy $15 billion in these masks every year, according to Bain & Co. In mid-2017, GP launched JM Solution's Honey Luminous Royal Propolis Mask. Other masks soon followed, including the Active Bird's Nest Moisture Mask, the Active Jellyfish Vital Mask and, of course, the Active Pink Snail Brightening Mask (containing real snail extract), just to name a few. GP didn't advertise. Instead, it sent masks to China's top beauty influencers, who would in turn post reviews—for free—on Sina Weibo (China's equivalent of Twitter) or on TikTok, the short-video platform operated by Bytedance. Some influencers began buying masks in bulk and reselling them online. But it was the daigous who arguably made a significant difference. Daigous aren't limited to GP's masks or to Korea, but the THAAD boycott and the popularity of GP's influencers in China spawned a lucrative gray market for the daigous to exploit, buying masks in bulk in Korea and selling them to buyers at home who put complexion ahead of patriotism.  Kim poses in JM Solution's flagship store in Myeongdong, known as the epicenter of K-Beauty. Jun Michael ParkGP's allure to the daigous was also fed to some extent by its own competitor: Amorepacific limited how much of its products any single customer could buy. A spokesperson for Amorepacific says the company was more concerned with protecting and promoting its long-term brand image than with boosting short-term sales. GP had virtually no limits. By the end of 2018, GP had sold 800 million masks, a number that has now surpassed a billion. "Tourism was declining," says Eugene analyst Lee. "But sales of JM products at duty-free stores were rising. It was people who were selling them, not consuming them." Today, GP, the company that started out selling video games and accessories, counts on cosmetics—largely to China—for 90% of its sales, half of which now come from e-commerce platforms such as Alibaba's Tmall. Games and related accessories account for just 6%. GP Club's China-powered rise was so meteoric that analysts initially projected the company could be valued as high as 10 trillion won in an IPO. They've since brought that estimate Earthward—current projections are for a valuation of roughly 4 trillion won. "The 2018 financials, while impressive, were still less than what we thought they'd be," Lee says.  "JM Solution products have had a meteoric rise for sure, but GP Club, even when dealing solely with video games, was clearly successful," says Jane Han, GP's general sales director and its first cosmetics hire, in 2014. "What has not changed is our CEO's passion and sincerity for what he does and his meticulous focus on fully understanding all the details involved in bringing a product to market and selling it. That is one of his greatest strengths." As proof that it is no longer an upstart in China, GP now must grapple with the bane of so many brands there: counterfeiting. "Fake products are already in the Chinese market," says Florence Bernardin of Information & Inspiration, a research firm specializing in the Asian cosmetics market. Fake cosmetics not only undercut sales; sometimes tainted with dangerous chemicals, they can hurt unwitting consumers and spark a backlash against the genuine brand. China's social media is rife with complaints about counterfeit Korean cosmetics. GP says it's working to foil counterfeiters by monitoring online and offline sales channels, updating its packaging and working closely with its online partners such as Alibaba. Vigilance may curb copycats, but continued growth, analysts say, will depend largely on diversification into new products and markets. GP has expanded offices from Seoul into Guangzhou, Hangzhou, Hong Kong, Tokyo and Weihai in China's Shandong province. Roughly a quarter of its 170 employees are focused on R&D, it says, and it's now selling its cosmetics not only in China but also in Japan, Malaysia, Singapore, Thailand and back home in South Korea. "The next big market for cosmetic firms appears to be Southeast Asia," says Shinyoung Securities analyst Shin Su-yeon in Seoul. "K-Beauty is popular in the region. But it's a difficult market, fragmented between several countries." Kim hopes an IPO will give GP the cash it needs to bridge those divides. When all is said and done, though, success is a relative matter for Kim, who feels his father died prematurely: "My dream is to be able to spend the better part of my life comfortably with my family." —With additional reporting by Yue Wang Get Forbes' daily top headlines straight to your inbox for news on the world's most important entrepreneurs and superstars, expert career advice, and success secrets. |

| You are subscribed to email updates from "korean cosmetics" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

You are now reading the article Unmasking The Hidden Billionaire Behind A Korean Beauty Kingdom - Forbes with the link address https://hargadanspesifikasiparfum.blogspot.com/2019/08/unmasking-hidden-billionaire-behind_21.html